However, this nightmare is all too real and it has recently appears to be the case, given one of the current lawsuits against Experian. This lawsuit is the result of allegations that Experian violated the Fair Credit Reporting Act (FCRA) by inaccurately reporting debts that were discharged in bankruptcy.

Although, White et al. v. Experian may have started as a consumer whose credit problems went from bad to worse, due to inaccurate reporting. The $45 million dollar class action settlement is a testament to the numerous consumers who were failed, by what some people consider a trusted credit bureau. While the average consumer may find that it takes a class action suit, or "Act of God," to get results, when it comes to correcting erroneous credit reporting, you should know that not all consumers are created equal. In fact, the NY Times reported that a VIP list is maintained by the big 3 which allows wealthy consumers to have their credit reporting issues and concerns handled quickly and more effectively than that of the average consumer.

Believe it or not, inaccurate reporting is just one of the complaints currently alleging Experian has failed consumer expectations.

We have all seen the many commercials and sung along to the catchy "freecreditreport.com" jingles. Yet, many consumers quickly learned that the catchy tune was followed by a catch22. That's right. The free credit report claims are false and this type of customer deception has spawned numerous lawsuits and and FTC settlements as can be seen here, here and here). Despite the "free" claims, those who tried to take advantage of the deal quickly realized that their credit report would cost a monthly fee of $14.95 and require consumers to sign up for a credit monitoring service.

Image via Wikipedia

Shocked? Well if true, you should be disgusted.

A recently filed California federal lawsuit, which seeks class action status, claims that Experian is intentionally confusing customers, engaging in false and deceptive advertising and not providing the consumer what they think they have purchased when signing up for services at Experian's FreeCreditReport.com and FreeCreditScore.com websites.

Complaints allege that the 3 digit score that consumers were provided along with the $14.95 credit monitoring service is not the same as the Experian FICO score.

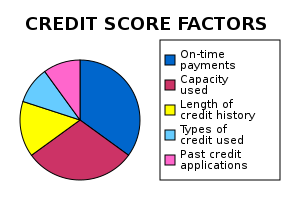

Experian is one of three major credit bureaus that actually provide data to Fair Isaac Corp., the organization that developed the FICO score. Experian maintains a FICO score but this consumer driven lawsuit claims that instead of consumers receiving the FICO score they believe they are purchasing, they are given an Experian PLUS score. The issue at hand is that the Experian advertising repeatedly references the credit score that lenders use. However, the Experian PLUS score is a 3 digit number based on Experian's own in-house model. It is unknown how close the PLUS score actually comes to the FICO score. Though, it is a fact that lenders, creditors, and others do not use this score to judge credit worthiness.

See a recent article on FICO credit scoring issues at The Cutting Edge News: FICO Has Key Role in Every American's Access to Credit

(here's a short excerpt):

According to Fair Isaac, "A 100-point difference in your FICO score could mean over $40,000 extra in interest payments over the life of a 30-year mortgage on a $300,000 home loan."

"That number is a passport to whether people can get ahead in life," said Ed Mierzwinski, director of the U.S. Public Interest Research Group's consumer program. "And nobody knows what it's derived from."

Putting the fair back in fair credit reporting -may only come with competition

The major shocker to some of us, is that in our customer driven, credit based economy, we the consumer have no say in which a credit bureau is allowed to report our data.

The absence of competition and the need to please the consumer gave birth to a credit reporting industry with little accountability or incentive to improve a flawed process. If we, as consumers were able to choose the bureau that reported our credit related information, competition would fuel the race for efficiency, practicality and accountability. It shouldn't be lost on anyone how important it is to have accurate data reporting, especially for the purpose of a credit rating considering how many things we intend to purchase are dependent upon those scores. However, due to the fact that consumers lack the influence of a lobbyist or the voice of a politician, it is a foregone conclusion that little relevant change will be adopted by Experian or any of the credit rating bureaus anytime soon. So, we as consumers are forced to continually investigate all the credit related data reported for us.

Isn't it time for a real change?

NEWSLETTER SIGN UP

NEWSLETTER SIGN UP SUBSCRIBE

SUBSCRIBE CONTACT

CONTACT

Leave a comment